Does Fed Interest Rate Impact Credit Cards: What You Need To Know

How Interest Rate Hikes Affect Credit Card Debt, Mortgages, More

Keywords searched by users: Does Fed interest rate affect credit cards why did my credit card interest rate go up 2023, why did my interest rate go up on my credit card, how can the federal reserve influence the interest rate on credit cards?, when will credit card interest rates go down, credit card interest rates today, credit card interest rate increase laws, companies that lower credit card interest rates, how much have credit card interest rates gone up

Does The Fed Interest Rate Hike Affect Credit Cards?

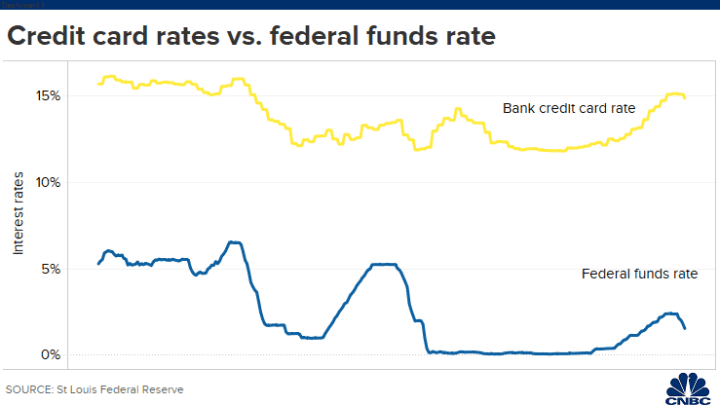

How does the Federal Reserve’s decision to increase interest rates impact credit cards and other financial products? When the Federal Reserve makes changes to the federal funds rate, it has a ripple effect on various consumer financial products such as credit cards, high-yield savings accounts, mortgages, and auto loans. From the perspective of consumers seeking credit, the consequences of additional rate hikes are expected to reverberate across multiple sectors, influencing borrowers across different industries. As of August 15, 2023, these rate hikes are poised to continue shaping the landscape of consumer credit.

Does Credit Card Interest Go Up When Interest Rates Rise?

When the prime rate increases, the interest rate on your credit card also goes up. It’s important to note that in this scenario, your credit card issuer is not obligated to provide you with a 45-day notice of the APR change, unlike some other circumstances where they are required to do so. Unfortunately, there’s not much you can do to prevent or control a prime rate hike. As of July 5, 2023, this remains a concern for credit cardholders, as it directly impacts the cost of carrying a balance on their credit cards.

How Does Interest Rate Affect Credit Card Balance?

Understanding the Impact of Interest Rates on Credit Card Balances

When it comes to comprehending the influence of interest rates on your credit card balance, it’s crucial to grasp the mechanics of how credit card interest functions. If you maintain an outstanding balance on your credit card, the card issuer employs a daily interest rate to calculate the additional amount you owe each day. This daily interest rate is determined by taking your annual interest rate, also known as the Annual Percentage Rate (APR), and dividing it by 365 days in a year. For instance, if your credit card carries an APR of 16%, the daily interest rate equates to 0.044%. This daily interest calculation method illuminates the incremental growth of your balance due to interest, shedding light on why managing and reducing credit card debt promptly is essential to financial well-being.

Aggregate 21 Does Fed interest rate affect credit cards

:max_bytes(150000):strip_icc()/ScreenShot2022-05-05at3.10.47PM-9401c217a6554ef38045747660cefed5.png)

Categories: Update 19 Does Fed Interest Rate Affect Credit Cards

See more here: xecogioinhapkhau.com

Bottom line. As a result of the Fed changing the federal funds rate, the prime rate also changes and your credit card APR will fluctuate accordingly — meaning an increase in the federal funds rate and prime rate results in an increase in your card’s APR.When the Fed alters the federal funds rate it affects consumer products like credit cards, high-yield savings accounts, mortgages and auto loans. “From a consumer credit perspective, the impact of further rate hikes will likely continue to be felt by borrowers across a range of industries.If the prime rate rises, the interest rate on your credit card will rise, too. This is another situation in which your issuer is not required to give you 45 days’ notice of a change to your APR. There’s not much you can do about an increase in the prime rate.

Learn more about the topic Does Fed interest rate affect credit cards.

- How Credit APR Is Affected When The Fed Raises Interest Rates

- How does the Fed’s rate hike impact credit cards? – Fortune

- 5 Times Your Credit Card Issuer Can Raise Your Interest Rate – NerdWallet

- Understanding Credit Card Interest – Investopedia

- Why did your credit card APR increase? – Chase Bank

- How Credit APR Is Affected When The Fed Raises Interest Rates – CNBC